Annuity Assignment Help

Equal series of payments, or receipts are called an annuity. There is should be an equal payments, and receipts with equal intervals. Monthly income, pension payments, insurance payments, and deposits into saving accounts. These are some common examples. Payment may be monthly, semiannually, yearly, and even weekly because it depends on the frequency of annuity. The basic types of annuity are ordinary, due, and perpetuity. The payments occur at the end of the period for example end of month or year, this type of annuity will be known as an ordinary. If payments occur at the beginning of the period, for example at the beginning of each month or year, so it is called an annuity due. If an equal series of payments continue forever, this type is called a perpetuity.

Furthermore, the most commonly use is an ordinary annuity. In below each type discuss separately. So, we thoroughly understand annuity concept.

Ordinary annuity:

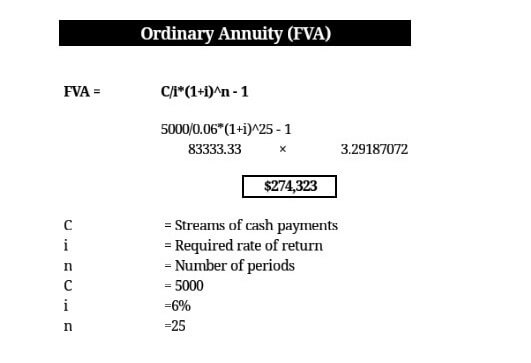

We calculate, and find the amount of ordinary annuity in two ways. First one is the future value, and the second is present value. The future value calculated through this formula.

- FVA = C/i ((1+i)^n – 1)

FVA = Future value

C = Streams of cash payments, or receipts

i = required rate of return

n= Number of payments/periods

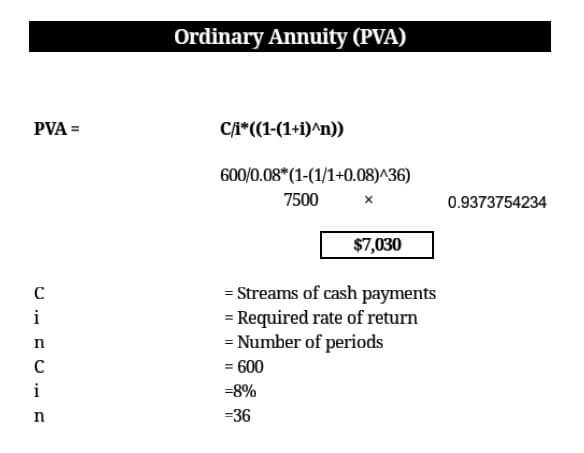

In addition, If we want to know the present value of an annuity. We use below given formula.

PVA = C/i (1- ( 1/1+i)^n)

Check quality assignment help free annuity sample here

Annuity due:

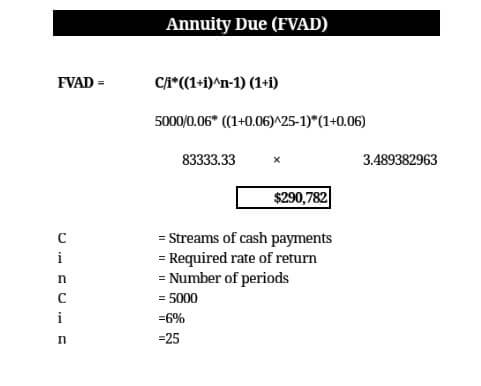

Equals a series of cash streams that occurs at the beginning of the period is known as an annuity due. Similar to an ordinary annuity, it is also calculated in two ways. The first way is future value annuity due, and the second method is the present value of an annuity due. To calculate future value we use following given formula.

- FVAD = C/i = ((1+i)^n -1) (1+i)

FVAD = Future value of Annuity due

C = Equal series of cash payments

i = required rate of return, or yield

n = Number of periods/payments

We find present value under given formula.

PVAD = C/i (1 – (1/1+i)^n)) (1+i)

Check quality assignment help free annuity sample here

Perpetuity:

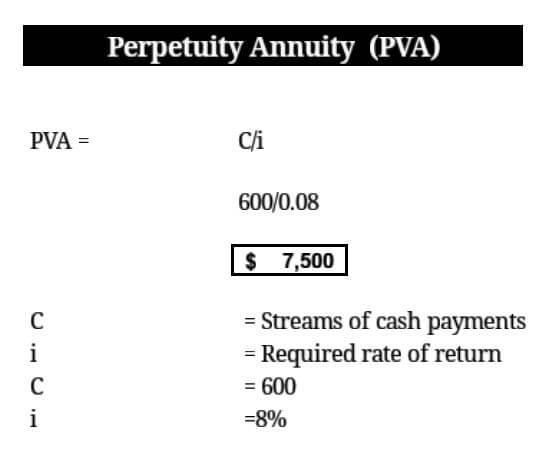

In perpetuity annuity, there is no number of periods. because equals streams of cash flows continue forever. In other words, perpetuity have no number of periods. To calculate perpetuity use below given formula.

PVA = C/i

PVA = Present value

FVA = Future Value

C = Cash payments

i = required rate of return

Question No. 1:

Alexander prepares an investment plan because he wants to save something for retirement age. According to his plan he want to invest in one of most prestigious national saving scheme, and he wants to invest $5000 per year. So, If the required rate of return is 6%, and Alexander continues to save and invest for 25 years. Than what will be the total value of Alexander investment?

So, what will be the total value of Alexander investment. If he starts to invest today, instead of at the end of the year?

Because of start investment in beginning period. So, this is the case of future value annuity due.

Question No: 2

Alex buys a property. He received rent from property $600 every month. If Alex invest his earnings from property into a stock market. The stock market currently gives an 8% required rate of return. So, if Alex continues to invest his earnings for the period of the next 3 years. Than what will be the present value of Alex investment?

What will be the present value of Alex investment. If his plan continues forever, instead of 3 years?

So, we see perpetuity case here.

In addition, for the purpose of calculating future value, than we should multiply instead of division. Therefore, using this techniques we may able to calculate future value of perpetuity. This is all about annuity.

If you still have any confusion regarding any financial help, please don’t hesitate to contact us. Quality assignment help experts are ready to help you. Click here

Comments are closed.