Project Description

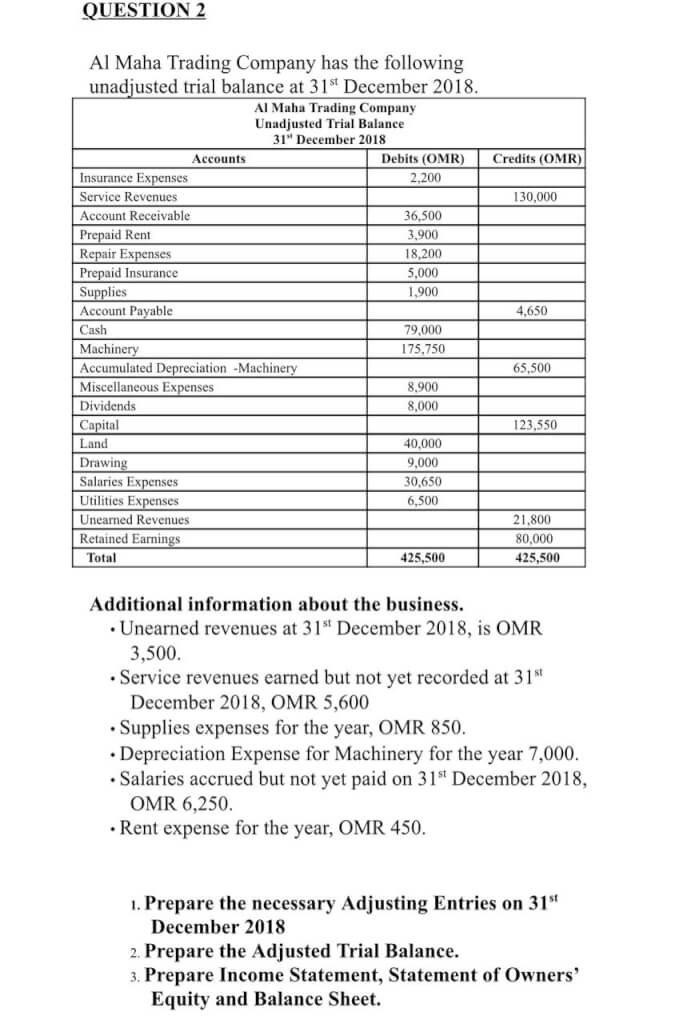

- Prepare the necessary Adjusting Entries on 31st December 2018

- Prepare the Adjusted Trial Balance

- Prepare Income Statement, Statement of Owners’ Equity and Balance Sheet.

Additional Information about the business,

- Unearned revenues at 31st December 2018, is OMR 3,500.

- Service revenues earned but not recorded at 31st December 2018, OMR 5600

- Supplies expense for the year, 850 OMR.

- Depreciation expense for the machinery for the year , 7000 omr

- Salaries accrued but not yet paid on 31st December 2018, OMR 6250

- Rent expense for the year Rs 450

UPLOAD YOUR FINANCE ASSIGNMENT HERE

[pdf-embedder url=”https://qualityassignmenthelp.com/wp-content/uploads/2020/04/Saifsolution.pdf” title=”Finance solution”]

[pdf-embedder url=”https://qualityassignmenthelp.com/wp-content/uploads/2020/04/Saifsolution-1.pdf” title=”income statement page 2″] [pdf-embedder url=”https://qualityassignmenthelp.com/wp-content/uploads/2020/04/Saifsolution2.pdf”]

[pdf-embedder url=”https://qualityassignmenthelp.com/wp-content/uploads/2020/04/Saifsolution3.pdf” title=”income statement page 3″]

For Any kind of finance assignment help, equity help, calculation help, income statement help please upload your requirement here

UPLOAD YOUR FINANCE ASSIGNMENT HERE

Project Details

- Date April 2, 2020

- Tags EXCEL, Finance assignment help